May 18, 2009

Earlier this year, much hullabaloo was made about Google’s capital allocation decisions. While the traditional acquisitions, cash used in investing activities, and minimum guaranteed payments for ad inventory (i.e. MySpace) were scrutinized, particular media attention was placed on Google’s rate of hiring.

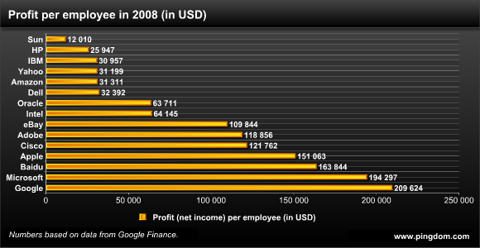

Well, according to recent analysis done by Pingdom, maybe the headcount worries were a little premature. In fact, while overhead costs may be increasing, Google remains the most profitable business on a per employee basis amongst all of its peers thus proving out the scalability of a web services business model.

While the fact that Google is remarkably profitable on a per-employee basis is somewhat reassuring, attention must still be paid to how well the Company is able to maintain this level of profitability. The law of diminishing marginal returns dictates that eventually new hires will become less and less profitable. Moreover, the value of investing in the overhead necessary to support new employees may no longer be worth the return. From the looks of it, Google is nowhere near confronting this dilemma as of yet, but clearly market participants were on edge over the idea of hiring during a recession.

Why would investors worry about investing in human capital for earnings growth? Remember, stock ownership represents a claim on the residual cash flows of a business. That means that as an investor, you have an indirect claim to the money a business makes. Now, because public companies are owned by many decentralized shareholders, decisions are made by a representative board of directors and a management team entrusted to make decisions on your behalf.

For many businesses, a significant portion of earnings is reinvested in the business to promote future growth. In the case of Google, a non-dividend paying stock, this means that all the present value you could derive from holding the stock is being reinvested rather than delivered directly to you in the form of a dividend. Since you could just as well have taken that money and invested it elsewhere for a given return, management at Google must prove that it is using your money wisely by reinvesting in various areas.

Profitability per employee is just one metric that you can use to gauge the successfulness of a management team. More interesting might be profit margin percentage per employee which would be an interesting approximation of return on human assets.

More traditionally, investors are interested in more holistic measures like Return on Invested Capital or Return on Equity. To read more about how to properly assess management capital allocation decisions check out my post on, “Finding Stocks with Great Management Teams.”

Source: http://seekingalpha.com/article/138184-should-google-just-keep-hiring

Posted via web from Pulse Poll

No comments:

Post a Comment